MILLIONS are set for more mortgage misery as interest rates hit a 15-year high today.

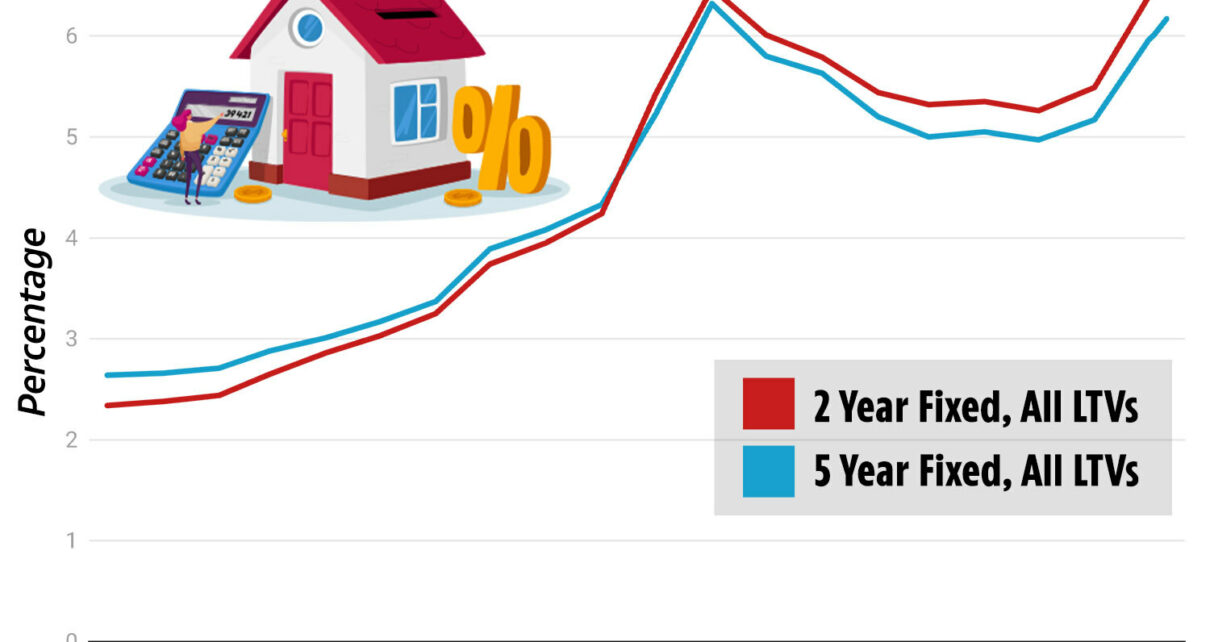

The average rate on a two-year fixed mortgage soared again, this time to 6.66%, the highest its been since 2008.

It's the first time this year two-year fixed rates have gone over the 6.65% spike that followed September's doomed mini-Budget and the market panic it triggered.

The figures from data site MoneyFactsCompare come just a week after the average interest rate on a five-year fixed rate mortgage broke the 6% barrier for the first time this year – ticking up from 5.97% to 6.01% overnight.

The latest data shows five-year fixed rates have also climbed, with the average now at 6.17%, though it's still a little way off its recent peak of 6.51% in October 2022.

Rates have been on the rise again amid expectations that interest rates will need to stay higher for longer as the Bank of England tries to tackle "sticky" high inflation.

READ MORE IN MONEY

Major mortgage rule shake up from TODAY – how it affects you

I’m a mortgage expert – how to choose between a two or five year fix

The central bank increased rates by 0.5 percentage points in June from 4.5% to 5%, the highest in just under 15 years since September 2008.

It was also the thirteenth time in a row that the Bank of England has raised rates since December 2021 when they were at historic lows.

Today's figures will pile on yet more misery for mortgage holders, particularly those who are set to remortgage in the coming months.

Around 2.4 million fixed rate mortgage deals are due to end between now and the end of next year, according to UK Finance.

Most read in Money

Amazon Prime Day 2023 best deals including air fryers and hair straighteners

Cash boost of £1,000 per year under new plans from Chancellor Jeremy Hunt

McVities is bringing back a discontinued favourite after almost 20 years

High street shop you've never heard of that's a rival to Greggs but cheaper

Rachel Springall, a finance expert at Moneyfactscompare.co.uk, said: “Borrowers may be disappointed to see the average two-year fixed mortgage rate has risen to its highest point in 15 years.

“Those borrowers concerned over (the) affordability of a deal might pause their home ownership plans, or indeed park the idea of refinancing.

“There are still some competitive deals out there for consumers to choose from, so it’s vital that borrowers seek advice to go through their options. Anyone struggling to pay their mortgage, or reaching the end of a low fixed rate, would be wise to speak to their lender immediately.”

In a bid to help those struggling with higher monthly payments, the government brought in new measures yesterday.

These include making it easier for borrowers to extend the term of their mortgage and move to interest-only repayments for up to six months without it harming their credit score.

A new consumer duty, which takes effect at the end of the month, will also force lenders to offer support that meets a customer’s individual needs, communicate clearly with people about their options and provide decent customer service.

Mortgage lenders are facing a grilling from MPs this morning about the stress felt by borrowers, those falling behind on payments and the larger impact on the housing market.

How to get the best deal on your mortgage

If you're looking for a traditional type of mortgage, getting the best rates depends entirely on what's available at any given time.

But there are several ways to land the best deal.

Usually the larger the deposit you have the lower the rate you can get.

If you're remortgaging and your loan-to-value ratio has changed this could also give you access to better rates than before.

A change to your credit score or a better salary could also help you access better rates.

If you have a fixed rate, you could see higher rates when you come to the end of the current term after thirteen Bank rate rises since December 2021.

And if you're nearing the end of a fixed deal in the next six months it's worth contacting your broker now to lock in a rate.

If they come down between now and the end of your deal, you can always apply for another rate before you remortgage.

Leaving a fixed deal early will usually come with an early exit fee, so you want to avoid this extra cost.

But depending on the cost and how much you could save by switching versus sticking, it could be worth paying to leave the deal – but compare the costs first.

To find the best deal use a mortgage comparison tool to see what's available.

You can also go to a mortgage broker who can compare for you, with most offering free advice to secure you the best deal for you.

Some brokers charge for advice, so ask them first.

It could cost a couple of hundred pounds but it might save you thousands on your mortgage overall.

You'll also need to factor in fees for the mortgage, though some have no fees at all, or you can add it to the cost of the mortgage, but beware that means you'll pay interest on it and so will cost more in the long term.

You can use a mortgage calculator to see how much you could borrow.

Remember, if you decide to remortgage to a new lender you'll have to pass the lender's strict eligibility criteria too, which will include affordability checks, and looking at your credit file.

Read More on The Sun

Strictly Come Dancing ‘sign up first ever Love Island contestant’ for 2023 show

How UK’s youngest lotto winner went from £1.8m jackpot to shopping at Iceland

You may also need to provide documents such as utility bills, proof of benefits, your last three month's payslips, passports and bank statements.

It's possible to avoid new affordability checks by remortgaging to a new deal with your existing lender, providing you don't want to borrow more or extend your term.

Do you have a money problem that needs sorting? Get in touch by emailing [email protected].

You can also join our new Sun Money Facebook group to share stories and tips and engage with the consumer team and other group members.

Source: Read Full Article