It’s no secret that renting in London is expensive compared to the rest of the country.

Those living outside the capital are only too quick to mention that higher wages make up for the city’s astronomical housing costs.

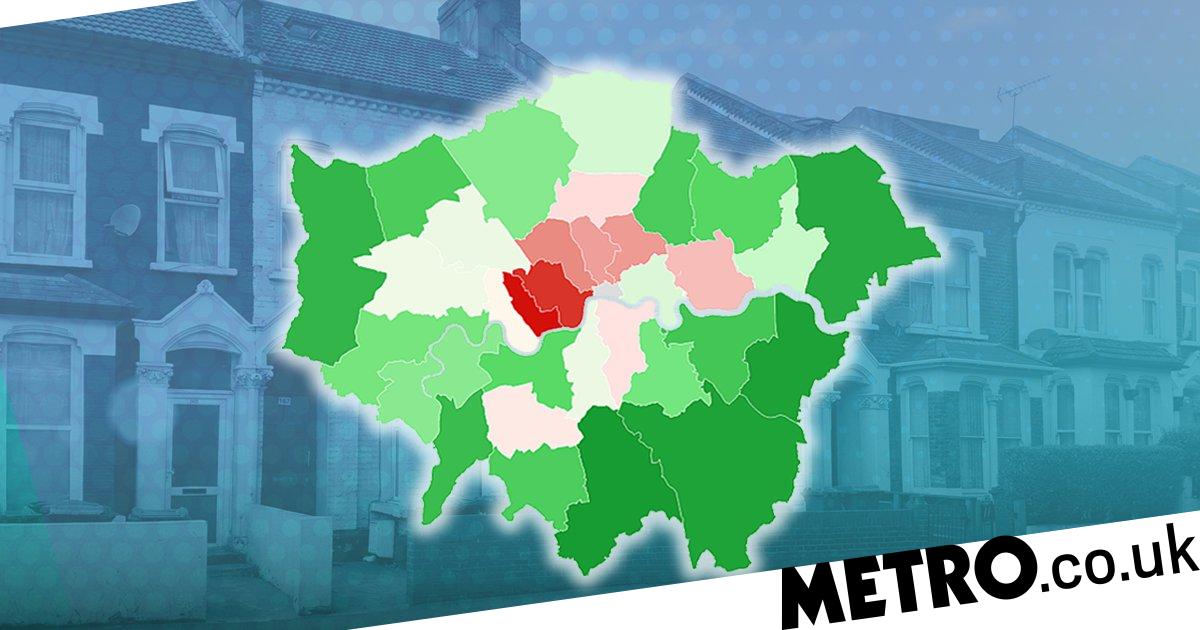

But a new study puts paid to that myth, revealing that tenants in London spend 53.6% of their incomes on rent – and in certain boroughs this figure rises to over 80%.

The research, by property insurance specialists Alan Boswell, looked at median salaries and rental costs for two-bedroom homes across the UK.

While the monthly London income is higher than any other region at £2,798, the average rental cost takes up a large proportion of that, coming in at £1,500 per month.

Most guidance claims housing costs should take up less than 30% of your take-home pay, but this data shows it’s an impossible target for many.

Latest London news

- London to get ‘Superloop’ to help get people round edge of city quicker

- How does Ulez differ from the congestion charge – and do you need to pay both?

- Commuter shocked to spot a skunk at London bus stop

To get the latest news from the capital visit Metro.co.uk’s visit Metro’s London news hub.

Even in the most affordable Greater London boroughs (including Croydon and Bexley) you’re looking at a minimum of 43.2% of your income going straight to a landlord.

When it comes to swankier areas like Kensington and Chelsea, median rents make up 87.3% of median earnings, and the gentrification hotspots of Camden and Hackney aren’t much better at 68.6% and 64.7% respectively.

There were also some surprises in terms of the boroughs featured. According to the figures, it’s cheaper to rent in Newham than Hammersmith and Fulham, while tenants in Tower Hamlets spend more on housing than those in Wandsworth.

Outside London, the North East takes the title of the most affordable region. Renting here takes up an average of 23.5% of income, while Wales follows closely at 27.2% and Yorkshire and the Humber is in third at 27.7%.

Heath Alexander-Bew, director of personal lines at Alan Boswell, commented: ‘While Londoners in high-rent areas likely have higher salaries or additional compensation to help them live on what’s left of that income, others may have to make compromises between location and price more frequently than before.’

A spokesperson from London Renters Union added: ‘London renters are at breaking point. It is unfair that a growing number of people are trapped in an extortionate rental market, forced to forfeit a massive proportion of their income for a housing system that gives them nothing long-term in return.’

Sufficiently depressed? Check out the most and least affordable parts of London for renters.

Is enough being done to support people through the cost of living crisis? Have your say now

London’s least affordable boroughs for private tenants

1. Kensington and Chelsea

- Median monthly income: £3,088

- Median monthly rent: £2,695

- Proportion of income spent on rent: 87.3%

2. Westminster

- Median monthly income: £3,198

- Median monthly rent: £2,687

- Proportion of income spent on rent: 84.5%

3. Camden

- Median monthly income: £2,991

- Median monthly rent: £2,050

- Proportion of income spent on rent: 68.6%

4. Hackney

- Median monthly income: £2,704

- Median monthly rent: £2,050

- Proportion of income spent on rent: 64.7%

5. Islington

- Median monthly income: £3,037

- Median monthly rent: £1,925

- Proportion of income spent on rent: 63.4%

London’s most affordable boroughs for private tenants

1. Croydon

- Median monthly income: £2,893

- Median monthly rent: £1,250

- Proportion of income spent on rent: 43.2%

2. Bexley

- Median monthly income: £2,780

- Median monthly rent: £1,225

- Proportion of income spent on rent: 44.1%

3. Bromley

- Median monthly income: £3,054

- Median monthly rent: £1,350

- Proportion of income spent on rent: 44.2%

4. Havering

- Median monthly income: £2,658

- Median monthly rent: £1,200

- Proportion of income spent on rent: 45.2%

5. Hillingdon

- Median monthly income: £2,728

- Median monthly rent: £1,275

- Proportion of income spent on rent: 46.7%

Do you have a story to share?

Get in touch by emailing [email protected].

Source: Read Full Article