Save articles for later

Add articles to your saved list and come back to them any time.

Key points

- Property consultant Richard Jenkins said more landlords are withholding their properties from prospective businesses for financial and personal reasons

- According to data from Plan1, Melbourne’s retail vacancy rate currently stands at 10 per cent but places like Chapel Street and Bridge Rd, Richmond, this number is higher, at about 20 per cent.

- Landlords are now facing steep land tax costs as their properties sit empty said Valuer John Katsis from Property Valuers and Advisors Group.

Every shopping strip seems to have them – empty shops that just never seem to find a tenant. Even on the once premier retail strip of Chapel Street, one in five shops sit empty and one South Yarra shopfront has been shuttered for nine months.

There are many reasons this can happen: retail downturns that thin demand, picky landlords looking for the right tenant, permit delays, redevelopment plans but also, experts say, owners sometimes will go to great lengths to avoid accepting a lower rent.

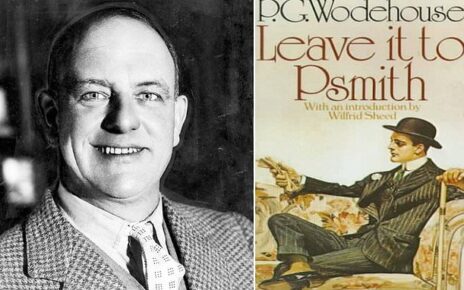

Richard Jenkins, director of property consultancy group Plan1, said some landlords are letting their shops stay vacant as they hold out for pre-COVID rents. Credit: Penny Stephens

This is the case in the Chapel Street shop that last welcomed a customer in February with the real estate agent saying the owner is “holding on to the rent price”.

The reason landlords will hold out for a higher rent, even if that means no rent, is because a retail property’s value is tied to the rent it yields. Accepting a lower rent can instantly drop the value of the property.

Property consultant Richard Jenkins, a director of Plan1, said the issue is becoming common as more landlords withhold their properties from prospective businesses for financial and personal reasons.

“Some landlords are holding out for the rents to come back [to] where they were before COVID,” said Jenkins, who has worked for global real estate company Knight Frank.

Melbourne retail vacancy rates in the past 20 years from Plan1

Plan1 data puts Melbourne’s current retail vacancy rate at 10 per cent, compared with the record highs during the pandemic, when the number was close to 15 per cent. On Chapel Street and Bridge Road in Richmond, the vacancy rate is even higher, at about 20 per cent.

For retail property owners, the stagnant nature of the commercial leasing market is not necessarily a strong motivation to lower prices, Jenkins said.

“Frequently these commercial properties are bought multi-generations ago and the actual mortgage is relatively low, so the landlords don’t need the income as much as other investors,” he said. “They can afford to do it.”

Valuer John Katsis from Property Valuers and Advisors Group agreed landlords were sometime hesitant to lower rents because of the impact on values.

“Unlike residential properties where the value of the property is determined by the direct sales comparison, as well as other factors like condition of the property and size, the value of commercial properties, like retail type properties, is directly linked to the relevant market rent,” Katsis said.

“This is because one of the methods of determining market value of commercial properties is using the income capitalisation approach…so when market rents fall it has a downward impact on values assuming yields remain the same.

“If landlords have more than one property, this could affect their entire portfolio.”

While debt might not worry some, Katsis said landlords were now facing steep land tax costs as their properties sit empty.

A for Lease sign in a shop in Chapel Street.Credit: Penny Stephens

“Land tax has gone pretty high and owners who have multiple properties that aren’t tenanted are hit with a big bill,” Katsis said.

One landlord, speaking anonymously, said he recently sold four commercial properties because of increasing land tax on his vacant spaces.

“If you drop your prices, you’re losing money as a landlord because there’s a certain cost for having a tenant – it’s not just rates and land tax, there’s continual inspection of the building, and you get calls about things that are broken or water ingress to fix,” he said.

The Morning Edition newsletter is our guide to the day’s most important and interesting stories, analysis and insights. Sign up here.

Most Viewed in National

From our partners

Source: Read Full Article