The Biden administration has discharged $34 billion in student loan debt for 1.7 million borrowers since the president took office a little more than seven months ago.

The discharged debt includes $10 billion for over 175,000 borrowers through the public service loan forgiveness (PSLF) waiver; $9 billion for permanent disability discharges for more than 425,000 borrowers; and $14.5 billion for nearly 1.1 million defrauded borrowers, according to figures the Education Department (ED) provided Yahoo Money.

The discharges, which are not part of President Joe Biden’s forgiveness of up to $20,000 in student loans announced last week, underscore the administration’s efforts to address the student debt crisis.

“The $34 billion in loan discharge is more than any previous president has done,” Mark Kantrowitz, author and student loan expert, told Yahoo Money.

PSLF loan discharge for military and certain professions in public service

As an incentive to teachers, nurses, doctors, lawyers, and other professionals — especially in rural and urban areas — student debt forgiveness was offered to those who worked at least 10 years in public service jobs with federal, state, local, or certain non-profit organizations through the PSLF program.

PSLF is also available for military service members who don’t qualify for other military loan forgiveness programs like the Military College Loan Repayment Program (CLRP) or National Defense Student Loan Discharge.

The number of PSLF borrowers who got a discharge is likely to increase from the 175,000 figure the ED provided because of a new PSLF waiver. Last year, ED entered into a settlement following a lawsuit from the American Federation of Teachers (AFT) to offer a waiver allowing those denied loan forgiveness to reapply by Oct. 31.

The AFT sued ED after more than 98% of borrowers who applied for the PSLF program were denied loan forgiveness when Betsy DeVos was U.S. Education Secretary under the Trump Administration.

Still, the waiver may not be enough to reach all borrowers who could be eligible.

“To get loans discharged under the PSLF waiver, borrowers need to consolidate FFEL loans before applying for the PSLF waiver and consolidation can take 30 to 45 days,” Kantrowitz said. “It also doesn’t help when loan servicers aren’t providing borrowers correct information and PSLF doesn’t tell borrowers why they’re being denied.”

Biden administration removed challenges for borrowers eligible for disability discharge

Borrowers who have total and permanent disability are eligible for student loan debt discharges. Typically, military veterans who have a 100% disability connected to military service or who have a serious disability and are receiving Social Security benefits qualify.

“The problem has been that disabled borrowers had to jump through bureaucratic hoops to get relief and many were denied or had their discharge reinstated due to paperwork,” Kantrowitz said.

For example, if a borrower is a quadriplegic, filling out a form can be challenging and a barrier to apply for discharge. But if the borrower wanted an advocate to help fill out the form, they would need to complete yet another form, Kantrowitz said.

The Biden administration has worked to eliminate this hurdle for some disabled individuals by employing data matching from Veterans Affairs and Social Security Administration to make loan discharge automatic, Kantrowitz said.

There’s also the problem of the three-year, post-discharge income-monitoring requirement that has caused many discharges to be reinstated.

“Over 90% of the discharges were reinstated not because the borrower’s income increased, but rather because they didn’t submit paperwork,” Kantrowitz said. “It’s trapping disabled borrowers who can’t manage the paperwork, which is why there is a proposal to get rid of post-discharge monitoring.”

Defrauded borrowers or those whose school closed can apply for discharge

Many of the debt discharge announcements from ED were related to the “closed school loan discharge” and “borrower loan defense discharge” programs.

Predatory lending at for-profit schools exacerbated the student debt crisis in large part because they were accredited by the now terminated Accrediting Council for Independent Colleges and Schools (ACICS).

The Education Department (ED) revoked the accreditation status of ACICS after years of scandals related to for-profit schools and the student loans provided to students across the country.

Predatory for-profit schools targeted military veterans to take advantage of the federal funding available to them through programs like the GI Bill.

“We once described this target population as being viewed by fraudulent schools as dollar signs with backpacks,” Richard Cordray, chief operating officer at the Federal Student Aid (FSA), told Yahoo Finance Live in an exclusive interview.

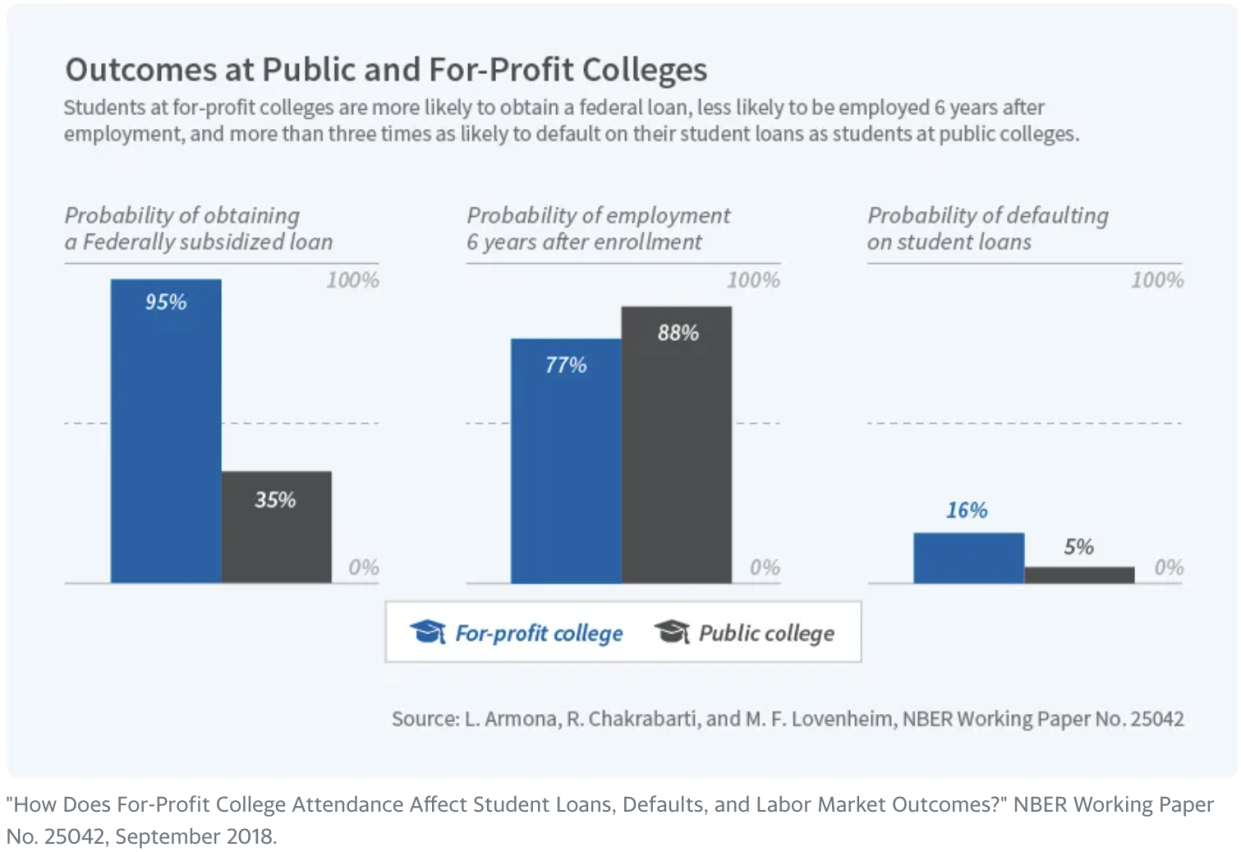

A 2018 National Bureau of Economic Research working paper found that students who attended for-profit colleges were more likely to obtain a federal loan than those who attend a public college and three times more likely to default on student loans — driven by the fact that these students were six times less likely to receive employment after enrollment compared with their public college peers.

Borrower defense applications surged after the Obama administration cracked down on predatory for-profit colleges in 2015 and created new regulations, but the mechanism for defrauded borrowers seeking debt relief broke down during the Trump administration under DeVos.

Advocates sued the Biden-era Education Department over the slow-moving debt relief process for students who said they had been waiting years for debt relief under the borrower defense to repayment process.

Most recently, the ED discharged $1.5 billion in student loans for 79,000 former defrauded students who attended for-profit Westwood College. The ED has previously announced loan discharges for former students at DeVry University, Corinthian Colleges, and ITT Tech.

Although ED has discharged $14.5 billion for nearly 1.1 million borrowers whose colleges took advantage of them, this number is likely to increase as borrowers saddled with college debt because of predatory lending practices at other for-profit institutions seek relief.

“The Biden-Harris Administration will continue ramping up oversight and accountability to protect students and taxpayers from abuse,” James Kvaal, ED’s under secretary, said in a statement announcing the latest action against Westwood College, “and ensure that executives who commit such harm never work at institutions that receive federal financial aid again.”

Ronda is a personal finance senior reporter for Yahoo Money and attorney with experience in law, insurance, education, and government. Follow her on Twitter @writesronda

Read the latest personal finance trends and news from Yahoo Money.

Follow Yahoo Finance on Twitter, Instagram, YouTube, Facebook, Flipboard, and LinkedIn.

Source: Read Full Article