Could 40-year fixed mortgages solve first-time buyer crisis? Ministers consider Dutch-style solution to help borrowers get on the property ladder – but critics slam it as ‘fiddling while Rome burns’ and a ‘terrible idea’

- Britons still paying very high rates for new mortgages compared to a year ago

- But Government has suggested longer-term deals could help first-time buyers

First-time buyers in Britain who cannot afford short-term fixed rate mortgages could be offered more 40-year deals under a plan being considered by the Government.

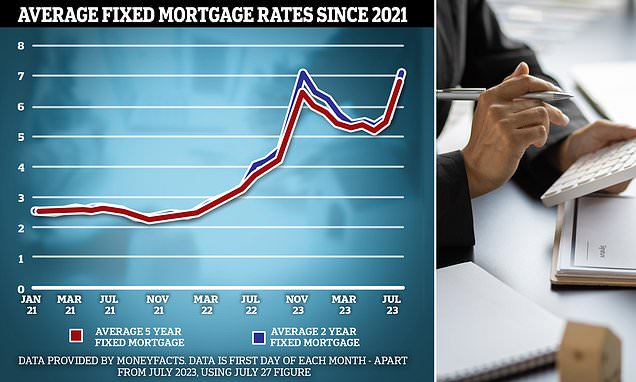

Borrowers are still having to pay extremely high rates for mortgages compared to one year ago, even though inflation is now falling at a greater rate than expected.

And the Treasury has now held talks with MPs, the Bank of England and lenders offering 40-year deals, which offer one interest rate for the entirety of the loan.

They are therefore likely to be cheaper than other deals and can be easier for first-time buyers to obtain while helping to protect against any future interest rate hikes.

Discussions have been held over regulatory changes that could help more firms offer the deal, including lowering capital requirements and easing loan-to-income limits.

Buyers currently need to be able to afford the lender’s standard variable rate – which is 7.67 per cent on average, according to Moneyfacts – plus 1 percentage point.

Light at the end of the tunnel? Slight fall in fixed mortgage rates

There was a glimmer of good news for borrowers today as the average fixed mortgage rates fell, although they are still significantly up on one year ago. Here is the data from Moneyfacts:

AVERAGE TWO-YEAR FIXED RATE

- Today: 6.83%

- Yesterday: 6.86%

- One year ago: 3.87%

- Today: 6.34%

- Yesterday: 6.36%

- One year ago: 4.02%

TOTAL NUMBER OF PRODUCTS

- Today: 5,016

- Yesterday: 4,962

Andrew Griffith, economic secretary to the Treasury, was involved in the talks last week, according to the Daily Telegraph.

Mr Griffith said he was ‘definitely interested’ in the 40-year deals, which are more common in the Netherlands and Denmark, to help more first-time buyers secure a property.

He added: ‘If a mortgage really is fixed [for the entire term] then the stress tests of affordability aren’t as relevant as there is no chance of payments rising.’

But some mortgage brokers criticised the plans today, with one describing it as a ‘terrible idea and a knee-jerk reaction to a transient problem’.

Lewis Shaw, mortgage expert at Shaw Financial Services in Mansfield, Nottinghamshire, also told MailOnline: ‘More credit means higher house prices, which means home ownership becomes out of reach for even more aspiring first-time buyers.

‘This doesn’t solve the problem but would only exacerbate it. We don’t have an issue with mortgages per se, we have an inflationary issue which will be fixed, and we have a problem with house prices completely detached from average wages.

‘A 40-year fixed-rate mortgage does not improve the underlying causes of where we are; this is fiddling while Rome burns.

‘The only way to sustainably help first-time buyers is to build more good quality affordable homes and to stimulate economic and wage growth without inflating property asset prices by wholesale root and branch reform of the property market.

‘We need to move from property speculation and seeing bricks and mortar as a store of wealth to what it’s designed for; a place to live.’

Andrew Griffith, economic secretary to the Treasury, has been holding talks on 40-year deals

Graham Cox, founder of SelfEmployedMortgageHub.com in Bristol, agreed. He told MailOnline: ‘Why stop at 40 years? Perhaps the term could be extended until death.

What mortgage experts say about the plans for 40-year fixed deals

Lewis Shaw, mortgage expert at Shaw Financial Services: ‘This is a terrible idea and a knee-jerk reaction to a transient problem. More credit means higher house prices, which means home ownership becomes out of reach for even more aspiring first-time buyers. This doesn’t solve the problem but would only exacerbate it.’

Jamie Lennox, director at Dimora Mortgages: ‘Taking such long term may seem appealing initially to reduce the monthly outlay. However, the longer the borrowing it can significantly increase the total amount payable over the full term of the mortgage and could quickly lead to tens of thousands of pounds of extra interest being paid.’

Riz Malik, director at R3 Mortgages: ‘Even though we’ve had long-term rates around for a while when rates were low, people never really used them much. Long-term fixed rates are not the solution to help first-time buyers in isolation.’

Justin Moy, managing director at EHF Mortgages: ‘Anything much longer than five years would be dangerous for first-time buyers, typically this is one of the client types that suffer most from early redemption, so any longer-term products for this type of client are not going to be popular.’

Graham Cox, founder at SelfEmployed MortgageHub.com: ‘What the young generation need are much lower house prices, higher wages or both. Not more extend and pretend.’

Rob Gill, managing director at Altura Mortgage Finance: ‘The UK property market in general needs longer-term thinking and such fixed rates should be part of the solution.’

Michelle Lawson, mortgage adviser at Lawson Financial Ltd: ‘As long as the applicants are aware that they are spreading the cost over a greater period of time and they will pay more in the long run I don’t see the harm.’

Neezam Romjon, co-founder at Rebus Financial Services: ‘I suspect 40-year term mortgages will soon become the norm amongst first-time buyers and home movers increasing their mortgage debt.’

Darryl Dhoffer, at The Mortgage Expert: ‘Bonkers – You’ll pay more interest! With a 40-year mortgage, you’ll be paying interest for a longer period. This means that you’ll end up paying more interest overall.’

Elliott Culley, director at Switch Mortgage Finance: ‘A 40-year term will make mortgage payments more manageable for some and stretching a term over a longer period can also increase the borrowing amount.’

Ashley Thomas, director at Magni Finance: ‘Longer fixed rates are common in other countries such as France. More choice is better in most situations, this would be the same.’

Stephen Perkins, managing director at Yellow Brick Mortgages: ‘Forty-year terms are a short-term necessity for many first-time buyers to be able to secure affordable mortgage payments.’

Andrew Montlake, managing director at Coreco: ‘There are few lenders waiting in the wings to bring to market a new breed of longer-term mortgages which crucially need to be very different from the traditional form if they are to be successful.’

Rohit Kohli, operations director at The Mortgage Stop: ‘Forty-year fixed-rate mortgages offer first-time buyers an important avenue towards homeownership in today’s challenging housing market.’

‘That way, first-time buyers can experience a lifetime of debt servitude and borrow even more, propping up house prices in perpetuity.

‘What the young generation need are much lower house prices, higher wages or both. Not more extend and pretend.’

Darryl Dhoffer, from The Mortgage Expert in Bedford, gave MailOnline an example of how the 40-year deal would lead to borrowers paying more interest, describing the scheme as ‘bonkers’.

He said: ‘With a 40-year mortgage, you’ll be paying interest for a longer period. This means that you’ll end up paying more interest overall.

‘For example, if you take out a 40-year mortgage at 4 per cent interest on a £200,000 loan, you’ll pay £140,000 in interest over the life of the loan. If you take out a 30-year mortgage at the same interest rate, you’ll pay £108,000 in interest.

‘You’ll build equity slower. With a 40-year mortgage, you’ll be paying more of your monthly payment towards interest and less towards capital. This means that it will take you longer to build equity in your home.

‘For example, after 10 years, you’ll have only paid off about 20 per cent of your loan with a 40-year mortgage. With a 30-year mortgage, you’ll have paid off about 35 per cent of your loan.

‘You’ll be more vulnerable to changes in interest rates: If interest rates reduce, you could be losing out on lower repayments, if you are tied on a 40-year mortgage with high early repayment charges.’

However, Rob Gill, managing director at Altura Mortgage Finance in London, took a different view and said he believes the ‘time has come’ for 40-year deals.

He told MailOnline: ‘Long-term fixed rates are commonplace in other countries and are surely an idea whose time has come in the UK.

‘Crucially, such products have no penalties, making them highly flexible as well as providing security for both the lender and the borrower.

‘The UK property market in general needs longer-term thinking and such fixed rates should be part of the solution.’

Giving a similar view was Neezam Romjon, co-founder at Rebus Financial Services in Peterborough, who told MailOnline: ‘I suspect 40-year term mortgages will soon become the norm amongst first-time buyers and home movers increasing their mortgage debt.

‘As 1 per cent mortgage rates disappear into the ether and house prices continuing to rise, we’re already seeing more interest from borrowers stretching out their mortgage term to keep the monthly payments affordable.

‘The upside is that you can minimise what you pay back on a monthly basis, the downside is that you’ll pay more interest to the bank in the long-term. Focus on what is your priority – paying less monthly, or paying less interest overall – and seek advice to fully understand your options.’

But Jamie Lennox, director at Dimora Mortgages in Norwich, issued a warning, telling MailOnline: ‘Taking such long term may seem appealing initially to reduce the monthly outlay.

‘However, the longer the borrowing it can significantly increase the total amount payable over the full term of the mortgage and could quickly lead to tens of thousands of pounds of extra interest being paid

‘If customers are to opt for longer terms while rates are high it’s important to make sure they review this regularly as if affordability improves over time they can look to shorten this down in the future.’

Meanwhile there was a glimmer of good news for borrowers today as the average two-year fixed rate fell to 6.83 per cent from 6.86 per cent yesterday, although it was just 3.87 per cent a year ago.

The average five-year deal also slid to 6.34 per cent today from 6.36 per cent the day before, but this was only 4.02 per cent a year ago, according to Moneyfacts.

The analysts added that there were a total of 5,016 residential mortgage products available today, which is slightly up from 4,962 yesterday.

Officials at the Bank of England, pictured on Tuesday, are also involved in the talks on deals

It comes after HSBC this week became the first major lender to cut rates on deals, sparking hope among homeowners that sky high rates will begin to drop.

READ MORE Coventry Building Society follows HSBC and cuts mortgage rates

The High Street bank’s move comes after figures released last week showed that inflation had eased by more than expected.

Several smaller lenders cut rates last week but HSBC was the first among Britain’s biggest banks to do so.

Following suit yesterday, Coventry Building Society said it would be cutting all its two and five-year fixed new home loan rates.

Last month, inflation fell at a greater rate than expected to 7.9 per cent, lower than the 8.2 per cent predicted by experts.

Financial markets now predict that the Bank of England will not need to raise interest rates as aggressively over the next year in order to control runaway inflation. Interest rates are now widely expected to peak below 6 per cent by the end of the year.

Source: Read Full Article