A YOUNG woman has shared how she bought her first home without the “bank of mum and dad”, managing to save a whopping £30k in just three years.

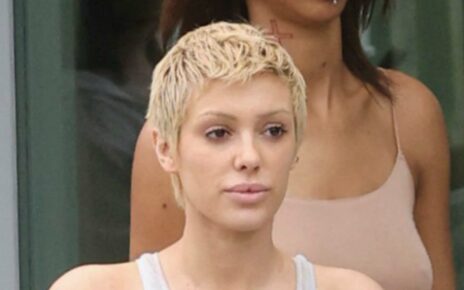

Despite being 23, Grace Sawyer has received the keys to her first home – a distant dream for many people in their 20s.

She and boyfriend, Callum Jones, were left distraught when mortgage rates started to rise and thought they'd be stuck in the rental cycle forever.

But thanks to some very savvy methods, the partnerships coordinator and recent masters graduate have managed to get a leg up on the market.

They used high-interest savings accounts, lifetime ISAs and premium bonds to bank a home deposit – all without any cash injections from their families.

A lifetime ISA is a savings account you can pay into for your first home or retirement, with the government topping up your savings with a bonus of 25% of everything you pay in, up to £1k.

read more on mortgages

We’d never have bought £453k first home without ‘lifeline’scheme – you can too

We were stuck on a soaring mortgage rate for MONTHS due to paperwork delays

Premium bonds, issued by NS&I, are government security savings accounts where your money is entered into monthly draws for cash prizes.

The top monthly prize is £1 million with hundreds of people winning the lowest prize of £25 in each draw.

The lottery bonds were introduced in 1956 and Brits are estimated to have £117 billion in them. However, each person can only hold a maximum of £50k in premium bonds.

Grace and Callum’s semi-detached home in Aberystwyth, Wales cost £220k and has three bedrooms and one bathroom.

Most read in Fabulous

Trolls call my baby chavvy because I dress her like she’s 16

How Charles has shaken up the royals – including ruthless ‘deep freeze’ of Harry

The moon and Jupiter create a career situation where second best won’t do

I was a size 12 & insecure – now I’m big, bald & I’ve never felt happier

"We sacrificed big fancy holidays and luxurious spending, but still enjoyed life through going on holidays in the UK,” Grace said.

"We were just sensible with budgeting and conscious of our spending and saving goals.”

Unfortunately, mortgage rates shot up as soon as the pair were looking to buy last year.

According to The Times, The Bank of England has increased rates 14 times since December 2021.

“The biggest stress was the climate, as everything was so up in the air with mortgage rates, bills and the cost of living crisis,” Grace said.

As they didn’t want to wait any longer, they had to accept the current market and instead, found a suitable home for £220k which needs a little bit of DIY.

“When I originally saw the property online, the fact that the toilet was in a separate room to the sink and bath was a big no go,” Grace said.

"But then, I widened my opinions and fell in love with the property, as it’s in such a great location and is of brilliant size.

“We haven’t started decorating just yet, but we’re hoping to create a more modern style, without taking away any of the homeliness.”

Her main advice for fellow 20-something-year-olds was to research into the best savings accounts to make the most of your money.

“Make the most of your lifetime ISAs, as we got £4,810.70 of ‘free’ money for saving in it for the past three years,” Grace said.

Read More on The Sun

Jack Whitehall shares first snap of newborn in hospital with Roxy Horner

Mum’s heartbreaking warning after twin girls, 4, suffocate to death inside toy box

“Also, utilise high-interest savings accounts and save regularly.

“Setting up a direct bank transfer is so helpful in making sure your savings stay as savings.”

Source: Read Full Article