ALEX BRUMMER: From water shortages to soaring energy bills and chaos at airports, greedy bosses have betrayed Margaret Thatcher’s privatisation dream

Back in the 1980s, Margaret Thatcher changed Britain’s economic landscape as she privatised swathes of business and public services.

Her vision was simple: freed from state control, utilities would be able to devote themselves to investing in the future — and serve the public better.

By the time Mrs T left office in 1990, more than 40 formerly state-owned UK businesses — employing some 600,000 people — had been sold to the highest bidders, with the total share of employees working in nationalised industries plunging from 9 per cent to just 2 per cent.

At first, standards improved dramatically under British Airways, British Telecom, British Steel and British Gas — to name just four of the companies swept up in the Thatcherite revolution.

But now the reputation of our privatised public services is at its lowest ebb since the Iron Lady came to power — and using and paying for them often feels like a rip-off.

The reputation of our privatised public services is at its lowest ebb since the Iron Lady came to power — and using and paying for them often feels like a rip-off.

Failed

According to the Met Office, England has just experienced the driest July since 1935, while East Anglia and south-east and southern England all suffered the most parched July since records began in 1836.

Some 3.5 million people are now subject to hosepipe bans, with millions more expected to join them soon.

Of course, the water firms — privatised by Thatcher in 1989 — are not responsible for the weather.

But they do have a responsibility to make reasonable preparations to deal with droughts — which, as climate-change doom-mongers never tire of telling us, are predicted to occur more frequently in years to come.

And in this, they have manifestly failed.

Instead, they have paid their bosses gargantuan salaries, and their foreign owners enormous dividends, while failing to invest in the infrastructure necessary to deal with a thirsty and growing population.

Last year, the chief executive of Thames Water, Sarah Bentley, was given a ‘performance-related’ bonus of nearly £500,000 — almost double her previous year’s payout and on top of her £750,000 salary.

This is despite the fact it has emerged that a £250 million water plant built to protect Londoners against droughts had been turned off by her outfit.

The water companies have also failed to invest in a much-needed distribution network or ‘grid’, which could move water from the wetter North to the parched South.

In a stark symbol of this intractable problem, it has been 31 years since a major water-supply reservoir opened in Britain: the last was Carsington Water in Derbyshire.

This is despite the fact that our population has soared from less than 58 million to more than 67 million in that time.

Also the water companies’ fault is a shocking history of failing to deal with leaks.

Three billion litres of water are lost every day in Britain thanks to leaky pipes — when the UK uses 14 billion litres daily.

This is not just wasteful: in many cases, the leaks pollute our rivers and coasts.

Three billion litres of water are lost every day in Britain thanks to leaky pipes — when the UK uses 14 billion litres daily.

Thames Water, along with five of the other biggest water companies (Anglian, Northumbrian, Southern, Yorkshire and Wessex), is now foreign-owned.

Indeed, it has been passed among overseas owners like an antique jug at a flea market, with little discernible improvement in service for its 15 million customers.

Since Thatcher’s pioneering privatisations, money-hungry predators hailing from faraway lands, including the Middle East, Singapore and Australia, have descended like locusts on Britain’s free and open market economy.

They have run these essential companies largely as financial assets instead of letting them serve their clear public purpose.

Thames Water’s earlier German owner, power giant RWE, fled the UK in the 2000s, following the Daily Mail’s damaging exposé of the pampered lifestyle of its bosses.

The firm was sold to the ‘vampire kangaroo’ Macquarie, an Australian outfit known for its ruthlessness.

Then it was subsequently resold to the Ontario Municipal Retirement Fund, Abu Dhabi Infinity Investments and various other foreign entities.

In the meantime, customers’ bills have climbed and the company has been fined almost £7 million for various misdemeanours since 2021 alone. Many would call the situation a disgrace.

But water is only one stark example of privatised utility companies letting down their customers.

As Britain’s energy bills surge, ministers are starting to worry about older and vulnerable people freezing to death in their homes this winter, and of widespread power cuts as firms have to pause production.

Our airports, meanwhile, are a disaster zone, riddled with cancellations, terrible service and lost bags.

A large slice of Heathrow, you may remember, is controlled by Spanish construction firm Ferrovial.

Weak

Millions of rail passengers are being held to ransom by militant trades unions, who are more concerned with a class war and their efforts to fell a Tory government than with the true interests of their members and the wellbeing of the passengers and taxpayers who subsidise the railways.

In all these cases, year after year, owners’ pledges of huge new investment to improve performance and resilience have never been properly fulfilled.

Weak regulation has also played a part in creating this mess. The water regulator Ofwat has done nothing to stem the great cash merry-go-around in that sector.

And in energy, the efforts by regulator Ofgem to create a more competitive marketplace have collapsed in recent months as wholesale energy prices have surged.

Some 30 out of the 60 or so new players who had entered the British market recently have now been driven out, with the Government having to pick up most of the bills.

This has left much of the market at the mercy of big overseas power companies such as Electricite de France (EDF), which supplies 5 million customers in the UK. And since President Macron has seized ownership of EDF back from the publicly quoted markets, much of the UK’s electricity will ultimately be controlled from Paris.

Given the strains in Franco-British relations — ranging from immigration to border controls — that is not a comforting thought.

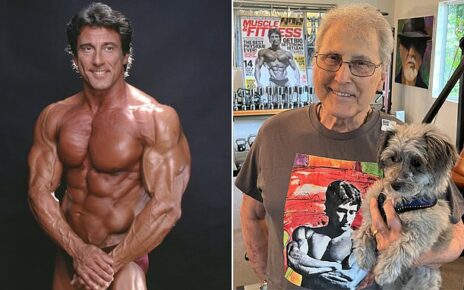

Liz Truss or Rishi Sunak (pictured), need to seek a new settlement with the utility companies and lead the country away from the rickety standards and a sub-par performance

Meltdown

Belatedly, British Gas’s UK-listed owner Centrica has woken up to this problem and agreed to invest up to £2 billion in renovating Britain’s gas storage capacity at Rough in the North Sea, in an effort to improve the UK’s resilience as soon as this winter.

But it’s too little, too late.

The meltdown in public services is an indictment not of privatisation per se, but of the way in which successive governments have betrayed Thatcher’s vision.

What’s needed now is better and tougher regulation and a proper focus on investment.

Our next Prime Minister, be it Liz Truss or Rishi Sunak, needs to seek a new settlement with the utility companies and lead the country away from the rickety standards and sub-par performance that this chronic lack of investment has engendered.

If they fail to do so, the danger is that Labour seizes the agenda, demanding a socialist return to full public ownership, which would see the state-run utilities having to compete for our money with the NHS and social care, education, defence and all the rest.

That’s a tussle that water, energy and transport would struggle to win. Thus we would witness the final undoing of the great Thatcherite legacy — and Britain would truly go back to the 1970s.

Source: Read Full Article