Apple CEO Tim Cook ‘was DENIED his own company’s credit card because he is high profile and a high-risk fraud target’

- The card has struggled since its 2020 introduction, with customers having accused the tech giant of holding their money ‘hostage’ weeks earlier

- The multi-billionaire had his account was noticed by credit bureaus due to checking several boxes that often lead to denials

- Cook is often the subject of scams and illegal impersonations and led him to be accidentally rejected

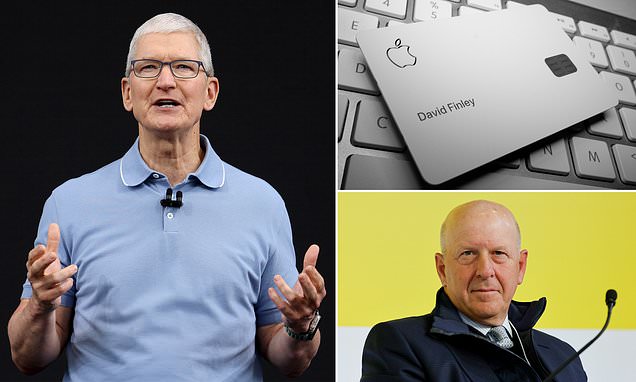

Apple CEO Tim Cook was reportedly rejected for his own company’s credit card in partnership with Goldman Sachs because he was mistakenly seen as a high-risk fraud target.

The card has struggled since its 2020 introduction, just last week quietly credited some of its savings account customers with $100 – after they accused the tech giant of holding their money ‘hostage.’

The multi-billionaire had his account was noticed by credit bureaus due to checking several boxes that often lead to denials in 2019.

The Information reported that Cook is often the subject of scams and illegal impersonations and led him to be accidentally rejected.

Goldman eventually overrode the case and Cook was able to acquire his own company’s card.

Apple CEO Tim Cook was reportedly rejected for his own company’s credit card in partnership with Goldman Sachs because he was mistakenly seen as a high-risk fraud target

DailyMail.com has reached out to Apple for comment on the matter.

The continued problems with the Apple Card venture, which began in October 2019, has led to rumors that Goldman will try and get out of the deal, according to the New York Post.

Increased interest rates and continued pessimism over the economy have made the partnership cost much more while becoming less profitable.

Bloomberg has reported that Goldman, led by CEO David Solomon, laid out $1billion in pre-tax losses on the Apple Card.

Apple reportedly can veto any attempt by Goldman Sachs to depart the operation.

The company’s savings account is only available to those who use its credit card, Apple Card.

Customers can open one in less than a minute directly from their iPhone and there is no minimum balance requirement.

It is also fee-free and offers a maximum balance of $250,000. And savers are free to access their money at any time – unlike many mainstream accounts which limit customers to six cash withdrawals a year.

Bloomberg has reported that Goldman, led by CEO David Solomon (pictured), laid out $1billion in pre-tax losses on the Apple Card

The continued problems with the Apple Card venture, which began in October 2019, has led to rumors that Goldman will try and get out of the deal

The yield on Apple’s savings account is more than ten times the average US savings rate, which is currently a paltry 0.39 percent

When it launched in April, it immediately garnered a great deal of attention due to its competitive rate. Sources told Forbes around 240,000 accounts were opened within the first week of business.

And two sources revealed that the offering drew in nearly $400 million deposits on its first day.

Savings rates have remained pitifully low compared to the cost of borrowing, with the average U.S yield now 0.39 percent, according to data from the Federal Deposit Insurance Corp. (FDIC).

It falls well below the Federal Reserve’s funds rate which is currently hovering between 5 and 5.25 percent. In theory, this figure should loosely determine saving rates offered by banks.

But Apple’s competitive deal means users can earn up to 10 times more over the course of a year.

For example, if a customer put $1,000 into a savings account which offered the Fed’s average yield of 0.39 percent and left it alone, they would earn just $3.90 interest in 12 months.

However with the Apple account, they would make $41.50 on their savings – a difference of $37.60.

Source: Read Full Article