Lloyds boss warns number of customers with debt problems has surged by a THIRD as cost-of-living crisis continues to bite

- Lloyds boss Charlie Nunn said 80% of customers have less than £500 in savings

- He told Radio 4’s Today people were ‘concerned’ but are ‘talking too negatively’

- Credit card spend on travel up 300% as people cut back on discretionary spends

- Bank offered majority of staff £1,000 bonus to help with the rising cost of living

Lloyds Bank has seen customers with persistent debt problems rise by nearly a third in six months as the cost-of-living crisis continues to bite the British people.

Bank boss Charlie Nunn, who became Lloyds CEO last year, said customers are ‘concerned’ about the economy but said people are talking ‘too negatively’ about their financial outlook.

This worrying development comes as inflation surged to a whopping 9.1% in May and is predicted to rise as high as 11% later this year due increases in the cost of energy, food and raw materials.

Mr Nunn told BBC Radio 4’s Today programme that Lloyds research shows three-quarters of their customers are worried about the cost-of-living crisis and the impact it is having on their savings.

Lloyds Bank has seen customers with persistent debt problems rise by nearly a third since the end of last year as the cost-of-living crisis continues to bite the British people

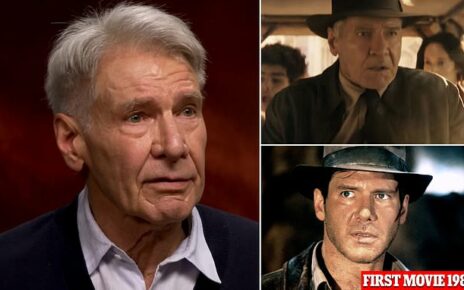

‘Around 80% of individuals and UK customers and families have less than £500 worth of savings in their current account and their savings account,’ said Lloyds CEO Charlie Nunn (pictured)

The proportion of people with persistent debt lifted by 30% since the end of 2021 as the financial backdrop continues to worsen, told the programme.

‘Customers are concerned, and they should be,’ he said.

‘We have seen some areas where there’s real points of challenge.

‘Around 80% of individuals and UK customers and families have less than £500 worth of savings in their current account and their savings account.

‘They might have money elsewhere but what we can see is less than £500.’

Household energy bills and petrol prices have massively risen in the past year.

From May last year to May this year, home gas prices rose by 85% and home electricity prices rose by 54%, according to government figures.

The chief Executive of Ofgem said in May that he expected the energy price cap rise again around £2,800 in October 2022 – about a 40% rise.

A petition to slash fuel duty was signed by 300,000 pained motorists – as fuel duty and VAT currently make up 85p of the current average £1.91 for a litre of unleaded petrol according to the RAC.

Homeowners could receive £350 off their annual energy bills if they agree to a wind farm being built nearby as Business Secretary Kwasi Kwarteng (right) tries to speed up production (Pictured left: Teesside Wind Farm)

Activists were arrested on Monday, July 4, after causing delays on major roads including on the M4 Prince of Wales Severn Bridge connecting Bristol with South Wales, was closed both ways except to a ‘go-slow’ demonstration as part of action calling for a cut in fuel duty.

Business Secretary Kwasi Kwarteng has said he will consider plans to offer communities a direct financial incentive to host new wind turbines – which could afford them £350 off their energy bills.

Lloyds Bank said last month it would hand a £1,000 bonus to the vast majority of its staff to help them cope with the rising cost of living.

Lloyds also revealed that around 20% of customers were cutting back on discretionary spending, such as eating out and activities, in order to keep more funds to use on essential items.

Nevertheless, the group also said credit card spending on travel is up 300% and suggested there was still positivity in some areas of the economy.

Mr Nunn suggested there could be a danger that the country could talk itself into a worse financial situation.

‘We are concerned that I think we collectively are talking ourselves into the risk of too negative an outlook,’ he said.

‘There are pockets of strength in the economy.

‘There are significant parts of the consumers in the UK who have strength and really want to spend and create that demand and we can continue to see opportunities to invest in growth.’

Source: Read Full Article