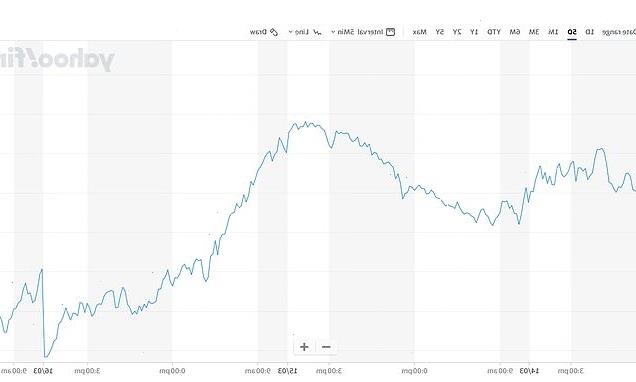

Markets stabilise after crisis-hit Credit Suisse gets massive £44bn bailout from Swiss central bank – but FTSE struggles to claw back ground amid ECB rate rise and fears of wider meltdown

Markets found some much-needed stability today after Credit Suisse secured a £44billion bailout from Switzerland’s central bank.

The bank, long seen as in trouble, fuelled fears of a global crisis after its shares tumbled by a quarter yesterday.

The Bank of England was said to be involved in emergency talks, with regulators on high alert after the collapse of Silicon Valley Bank sparked chaos over the weekend.

However, Credit Suisse regained much of the drop after announcing the huge loan option overnight.

The FTSE 100 index, which endured a miserable plunge yesterday, surged more than 90 points in early trading. However, it later faded, partly due to the European Central Bank pushing ahead with a 0.5 percentage point hike in interest rates.

The headquarters of Swiss bank Credit Suisse are pictured in Zurich (file image)

Markets found some much-needed stability today after Credit Suisse secured a £44billion bailout from Switzerland’s central bank

Since March 8 European banks have lost around £150billion in market value.

Credit Suisse is the first major global bank to be thrown an emergency lifeline since the 2008 financial crisis.

Chancellor Jeremy Hunt said he was ‘encouraged’ by the move this morning, as he toured broadcast studios in the wake of his Budget.

Credit Suisse’s troubles have raised serious doubts over whether central banks will be able to sustain aggressive interest rate hikes.

But the ECB defied the speculation by raising rates at lunchtime.

The central bank stressed the resilience of the euro area banking sector, arguing it had plenty of tools to offer liquidity support if needed.

The ECB said it was ‘monitoring current market tensions closely and stands ready to respond as necessary to preserve price stability and financial stability in the euro area’.

Traders are now split on whether the Bank of England will go ahead with rate rises next week.

They are also betting that the Federal Reserve, which last week was expected to accelerate its interest rate hikes in the face of persistent inflation, may hit pause or even reverse course.

Policymakers have stressed that the situation is not comparable to 2008 as banks are better capitalised and funds more easily available.

Allianz one of Europe’s biggest financial firms, said that authorities were ‘well equipped’ to deal with any liquidity crisis, ‘unlike what happened during’ the global financial crisis of 2007 and 2008.

Swiss authorities have insisted Credit Suisse meets ‘the capital and liquidity requirements imposed on systemically important banks’.

Chief Executive Ulrich Koerner told Credit Suisse staff in a memo they should focus on facts as he pledged to rapidly move forward with a plan to streamline operations.

The Bank of England raised interest rates from 3.5 per cent to 4 per cent last month – but there is speculation it might hold fire next week

Chancellor Jeremy Hunt (pictured speaking to the media in London this morning) said today that he welcomed efforts to boost the liquidity of bank Credit Suisse

The bank’s stock market value has fallen by 90 per cent since its peak in February 2007 of around $91 billion, to around $8.66 billion following a prolonged slide in its shares.

Analysts said that the measures will buy Credit Suisse time to carry out its planned restructuring, although there could well be further moves to pare back the Swiss lender.

‘We would not exclude the possibility of further restructuring statements from management designed to further simplify the bank,’ Thomas Hallett at KBW said in a note.

As its shares regained some ground, the cost of insuring exposure to Credit Suisse debt tumbled from record highs, while insurance protection on bonds issued by BNP Paribas, Deutsche Bank and UBS also inched back down.

SVB’s demise last week, followed by that of Signature Bank two days later, sent bank stocks on a roller-coaster ride as investors feared another collapse like Lehman Brothers, the Wall Street giant whose failure sparked the global financial crisis.

Source: Read Full Article