Public spending will be nearly £20billion lower in real terms by 2027-28 after Chancellor dodged increasing budgets, OBR warns – and targets are only being met due to assumption fuel duty will rise

Public spending will be nearly £20billion lower in real terms by 2027-28 after the Chancellor dodged increasing budgets amid soaring inflation, the Treasury’s watchdog warned today.

The Office for Budget Responsibility highlighted the scale of the squeeze in documents accompanying the Autumn Statement.

It pointed out that most of the extra headroom for Jeremy Hunt had been generated by the effects of inflation driving up revenues.

But rising prices also mean that the real value of departmental spending will be £19.1billion lower by 2027-28 than the OBR forecast in March.

The watchdog’s report questioned whether the government will be able to maintain the downward pressure on spending, branding the situation a ‘significant and growing risk to our forecast’.

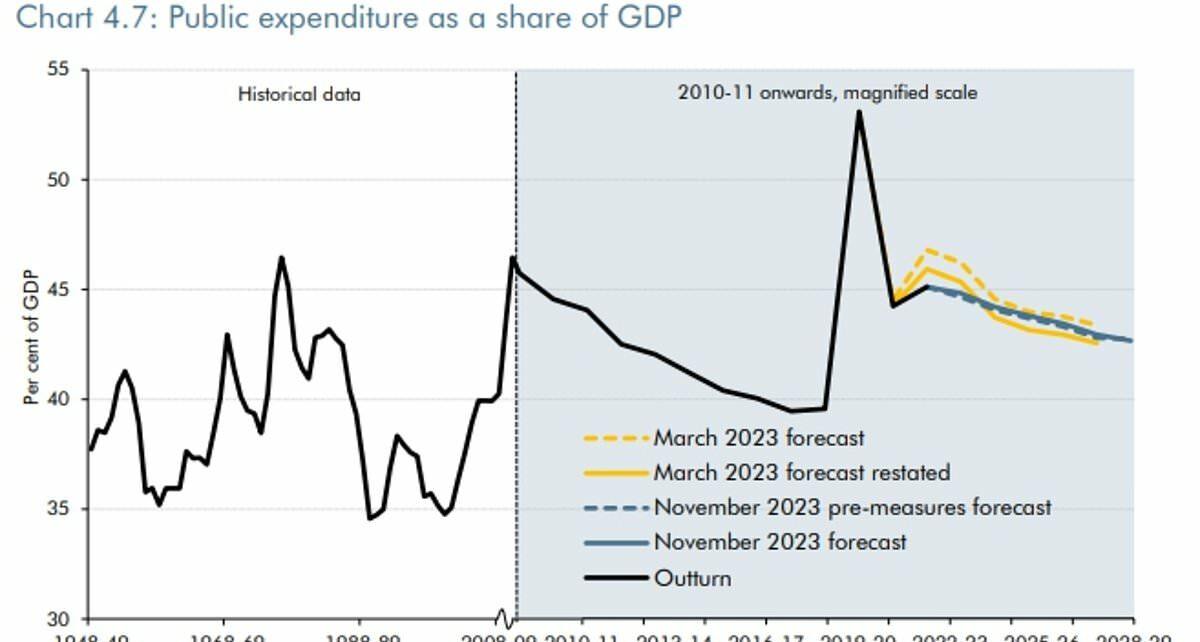

Inflation means that the real value of departmental spending will be £19.1billion lower by 2027-28 than the OBR forecast in March – although it is still higher than before Covid as a proportion of GDP

The OBR pointed out that most of the extra headroom for Jeremy Hunt had been generated by the effects of inflation driving up revenues

‘As previous spending reviews have approached, governments have topped up annual day-to-day spending envelopes significantly: by £39billion (14 per cent) on average in the year up to the November 2015 Spending Review, and by £32billion (8 per cent) in the October 2021 Spending Review,’ the report said.

‘The outlook for departmental spending is therefore a significant and growing risk to our forecast.’

Despite not keeping pace in real terms, the OBR said public spending remains higher as a proportion of GDP than before Covid.

The OBR pointed out that the headroom of around £13billion that the Chancellor had left himself to meet fiscal targets was well below the £20billion needed to keep real-terms departmental spending at the same level as the March forecast.

The independent body again took aim at the handling of fuel duty, pointing out that without assuming that fuel duty rises by RPI next year and the 5p ‘temporary’ duty cut is removed Mr Hunt would not meet his fiscal goals.

‘Fuel duty is expected to raise £24.4billion this year before rising to £28.2billion in 2024- 25, driven by the current stated policy to reverse the temporary 5p cut on the 23rd of March next year and index the duty rate by RPI from April 2024,’ the report said.

‘In practice, the Government’s indexation policy has rarely been implemented.’

The independent body again took aim at the handling of fuel duty, pointing out that without assuming that fuel duty rises by RPI next year and the 5p ‘temporary’ duty cut is removed Mr Hunt would not meet his fiscal goals

Source: Read Full Article